Risk Management

No matter how smart or accurate you are, history shows that there are always difficult dry runs, which may vary from 1 off trade to many more. Either the market might change or you just get really unlucky (these things happen and it’s a sad reality).

We all know that it is easy to get tilt and lose more than you are supposed to lose. If you don’t want your funds melting like a sugar in a hot cup of tea, then you should set up a proper risk management system as Steve did after taking his first big losses.

What leverage to use?

The truth is I would recommend using cross leverage for most trades. Nevertheless, if you decide to use isolated leverage you should never use more than 25x.

It’s just about statistics, odds are so heavily against you that you are not able to make profits in the long run. For example, if you use 100x, you will earn the profit on 100x but your liquidation is so much closer like you would use about 200x.

Steve always uses cross leverage now and remember the most important number is actually the percentage you are risking on a single trade.

How much to risk on a trade?

Truth to be told, Steve was a lucky bastard (he used at least 10% of his portfolio) and made a lot at the beginning with big risks but most of us are not that lucky. Now, as Steve has understood the risks in the unstable markets he knows how stupid he actually was.

Depending on a trade I would never invest more than 0.5% - 1% on a single trade. Imagine if you lose 3 trades in a row with 15%, then a big portion of your funds are gone and this is never a way to go. Row gently, arrive eventually.

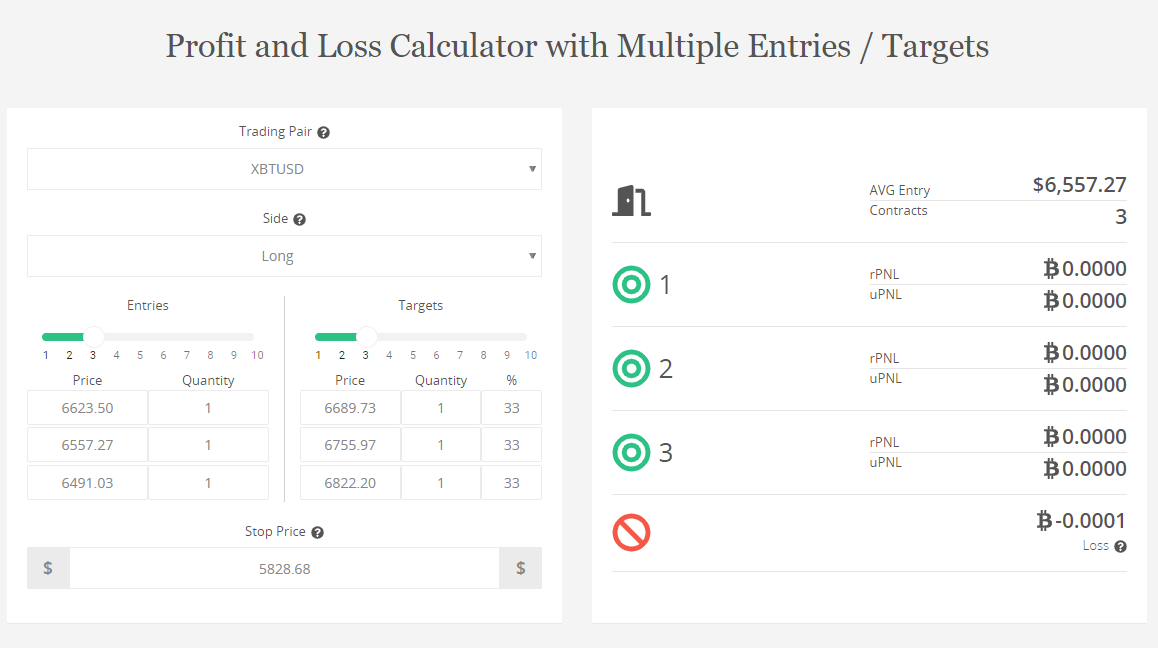

My personal approach is that I calculate risk based on the entry price and stop price, so that when stop-loss hits I know how much I lose per position. I can calculate the number of contracts I can afford based on the size of my portfolio.

Let’s say my risk percentage is 0.5%, it means 0.5% is the amount I am willing to lose, not the investment size itself. I have also implemented many different calculators on this web page. Feel free to play around with those: pnl calculator, target price calculator and advanced pnl calculator.

To sum up, once there was an inexperienced trader Steve, who started learning everything about margin trading on Bitmex. Steve can now proudly say that the student has become the master. If it’s even possible in margin trading. And always remember if you do anything in life, put your heart into it.

"Success is no accident. It is hard work, perseverance, learning, studying, sacrifice and most of all, love of what you are doing or learning to do." - Pele